In the insurance industry, the cost of a poor decision isn’t just financial — it’s reputational, operational, and strategic.

Forward-thinking teams aren’t relying solely on internal data anymore. Instead, they’re integrating external intelligence — geospatial, behavioural, and environmental — to drive sharper, more confident decisions at every level.

This is where GeoInt makes the difference.

From Insight to Impact: Contextualising Insurance Data

In our first article in the series, we explored how leading organisations extract value by combining internal data with contextual insight. In this article, we narrow the focus to insurance, showcasing how location-aware data can enhances pricing, planning, and product design.

Smarter Decisions with Visualised, Contextual Data

GeoInt provides access to high-resolution datasets tailored for the insurance sector, enabling improved risk management, planning, and performance. These include:

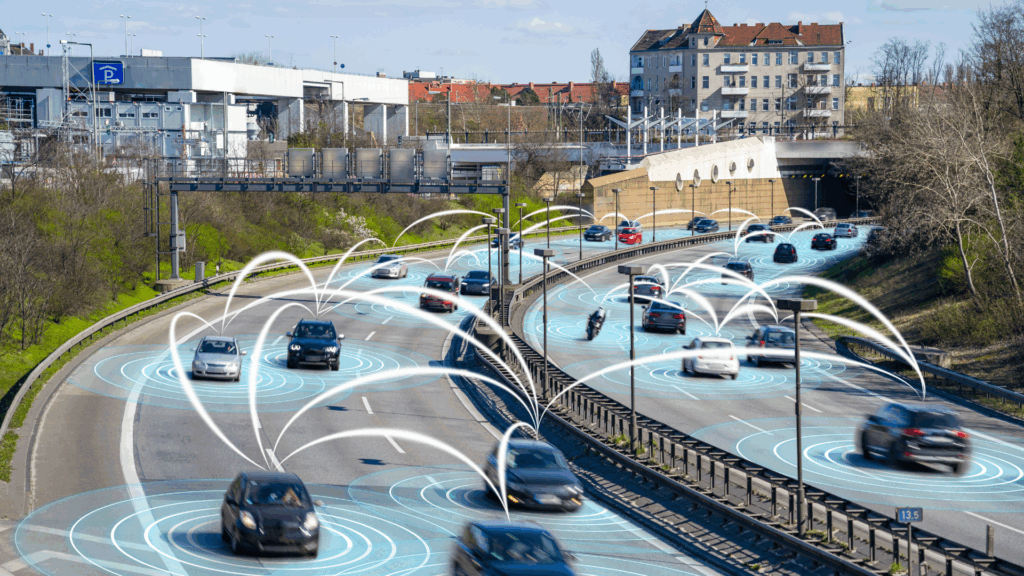

- Traffic Data: Real-time and historical road speed, congestion, and route density insights. Supports more accurate road risk assessment.

- Historical Accident Data: Identifies high-risk zones and patterns across traffic collisions, industrial accidents, and environmental disasters — crucial for pricing and claims exposure.

- Weather Data: Informs claims validation, service readiness, and disaster response through predictive event tracking. Real-time feeds also help fleet managers mitigate cargo damage and reroute vehicles in high-risk zones during heavy downpours, especially when accident probability increases on specific road segments.

- Telematics Data: With our extensive experience and knowledge of working with large volumes of asset tracking data we are able to provide insurance companies with value insights to derisk their services to large fleet and logistics providers. This could be used to reward clients or readjust and review premiums.

GeoInt’s visualisation platform, transforms this complex complex intelligence into simple, interactive dashboards and location-aware maps — no GIS or coding experience required.

Market Differentiation through Precision Marketing

For insurers and brokers, reaching the right audience is about more than demographics — it’s about understanding where opportunity meets risk, behaviour, and buying power.

GeoInt’s marketing effectiveness tools combine spatial intelligence with marketing data to help insurers:

- Locate and segment ideal customer groups based on demographics, behaviour, and insurance product usage

- Match marketing personas to real-world geographies using footfall, population density, and disposable income data

- Optimise out-of-home and digital campaigns by identifying high-traffic, high-potential zones

- Visualise return on investment spatially to continuously improve performance

This means smarter targeting, sharper messaging, and measurable returns — not just more leads, but better ones

Data Monetisation – Unlocking New Revenue Streams

With traditional margins under pressure, insurers are exploring how to monetise internal data assets. GeoInt works with you to unlock this value by transforming proprietary datasets into commercial tools.

Our solutions include:

- Risk dashboards for underwriting, credit scoring, or fleet management

- Fraud heatmaps for internal use or industry collaboration

- Embedded APIs that support brokers, quoting engines, or loan origination workflows

If your data is good enough to guide your decisions, it’s likely good enough to support the people and platforms you rely on.

Product Highlight: Road Risk Index (RRI)

What if you could predict the next accident before it happens?

The Road Risk Index (RRI) is a data-driven tool developed by GeoInt and partners to quantify road risk for insurers and fleet operators. It merges accident data, weather, and road conditions into a live risk score per road segment that adapts in real time.

Who is it for?

- Underwriters: Price policies more accurately using location-specific risk scores.

- Fleet & Risk Managers: Reroute vehicles in real time to avoid high-risk areas.

- Actuarial Teams: Improve loss models with dynamic exposure metrics.

Why it matters

- Moves from guesswork to data-backed risk assessment

- Unlocks pricing and safety gains

- Enables monetisation through APIs and partner platforms

Building the Future of Insurance, Together

If you’re building the future of insurance — reimagining how to price risk, design smarter products, or protect people and assets more effectively — your data should be working harder for you.

At GeoInt, we work with insurers and innovators to turn static datasets into living, decision-ready intelligence. Whether you’re a specialist underwriting firm or a multi-line insurer, our modular solutions flex to fit your strategy, not the other way around.

Because in a world this complex, better context means better decisions. Let’s build them, together. 👉 info@geoint.africa